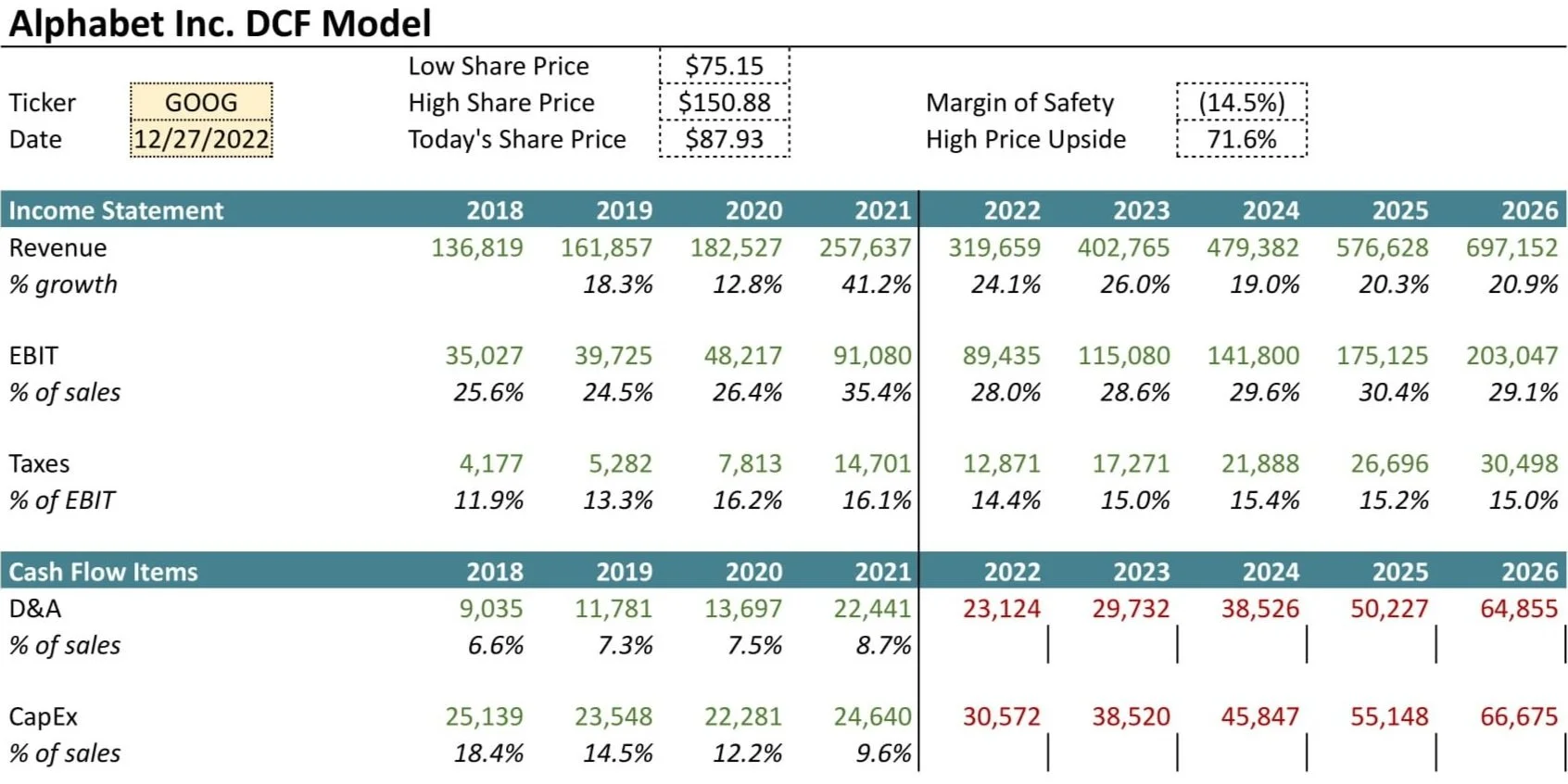

Valuation Analysis

Disclosure: The GOOG DCF model contains altered and omitted variables and is intended for informational purposes. The screenshot does not include calculations for WACC, PV FCF, Terminal Value, Enterprise Value, etc. - Potential employers may request a full unedited copy of this model for skill verification purposes. In addition, models using other techniques such as trading/transaction comps are available upon request.

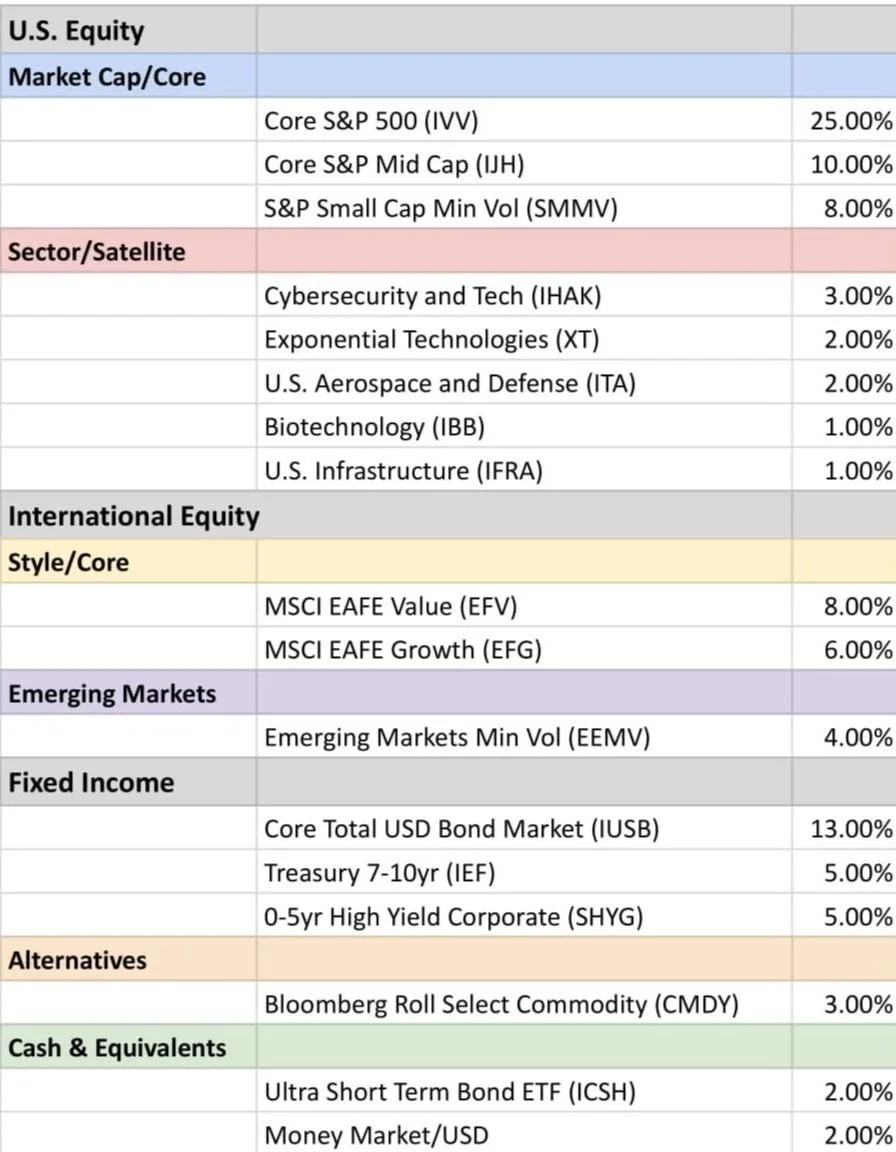

Multi-Asset Class Portfolio Construction

This is a sample 70/30 portfolio which implements a core/satellite approach. When done correctly, I believe the portfolio should be analyzed daily, but updated minimally. A thoughtful portfolio of ETF’s or mutual fuunds should be rebalanced as the market tilts the asset class weightings, but be able to withstand market volatility without a major overhaul. The satellite portion of the portfolio may be rebalanced or exchanged more often, depending on market conditions and IPS rules. In my opinion, many investors do not put enough thought into their fund selection or weightings, so they feel forced to overcorrect as the market changes, oftentimes chasing performance.

Angel investing and venture capital are fascinating arenas, requiring varying degrees of qualitative and quantitative analysis. Through my own private market experience, I believe you invest in the team (founder) first and the product second. This shouldn’t diminish the importance of the product, but bad management is a recipe for disaster. These are some of the companies I would explore to be on the forefront of the changing economy…

Startups Worth Watching

Desktop Metal

RevenueCat

Relativity Space

Calm

Kalshi

OpenAI

MicroAcquire

Anduril Industries

Deel

Vanta